Unlock Premier Real Estate Funding

Lending Exchange connects you with top-tier real estate lenders using smart, tech-powered tools. Our platform brings together experienced professionals offering a diverse range of loan products tailored to your investment needs.

Sign up

Why Choose Our Lender Network?

- Diverse Loan Products: Access financing options including fix and flip, rental, bridge, new construction, and commercial loans.

- Extensive Experience: Our lenders have collectively funded over $11.5 billion in real estate projects, showcasing their deep industry expertise.

- Fast and Efficient: Benefit from quick closings, with some lenders funding deals in as little as 7-10 days.

- Competitive Terms: Multiple lenders compete to offer you the best rates and terms, with examples like Fix & Flip loans starting at 8.99% and Rental loans at 6.625%.

- Wide Coverage: Our network includes lenders operating across a broad range of states, with some providing nationwide coverage in up to 46 states and others focusing on as few as 25 states for more specialized service.

Loan Products Available Through Our Network

Fix & Flip loans

Short-term financing for purchasing and renovating properties to sell for profit. Ideal for investors looking to turn around properties quickly. Rates start as low as 8.99%.

Rental property loans

Rental Loans: Long-term financing options, including DSCR (Debt Service Coverage Ratio) loans, for investors holding properties to generate rental income. These focus on property cash flow for qualification, with rates starting at 6.625%.

Bridge loans

Temporary financing to bridge the gap between buying a new property and selling an existing one, or while awaiting long-term funding.

Ground up construction loans

Funding for ground-up construction projects, supporting both residential and commercial developments from start to finish.

Commercial loans

Tailored financing solutions for a range of commercial real estate ventures, such as multifamily buildings, office spaces, and retail properties.

Secure funding in three simple steps

Create your project in one click

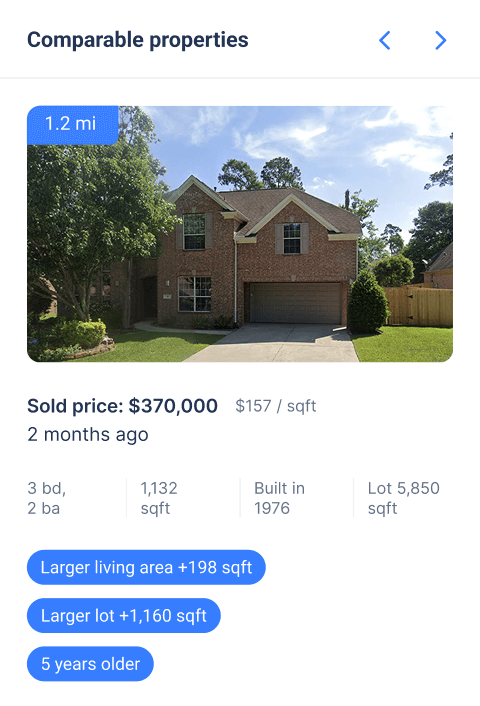

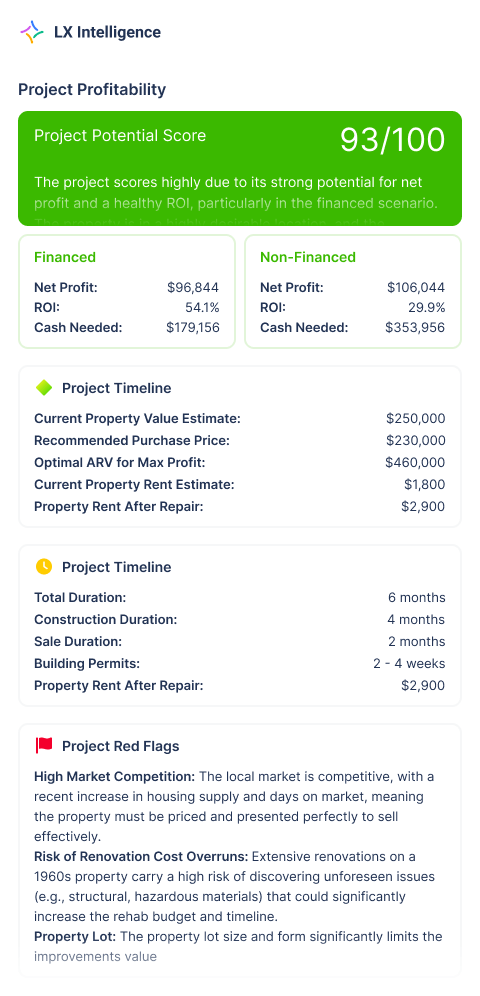

Create your real estate project to begin reviewing data in a few simple clicks. Evaluate property and market data to validate assumptions with the help of verified information and streamlined tools

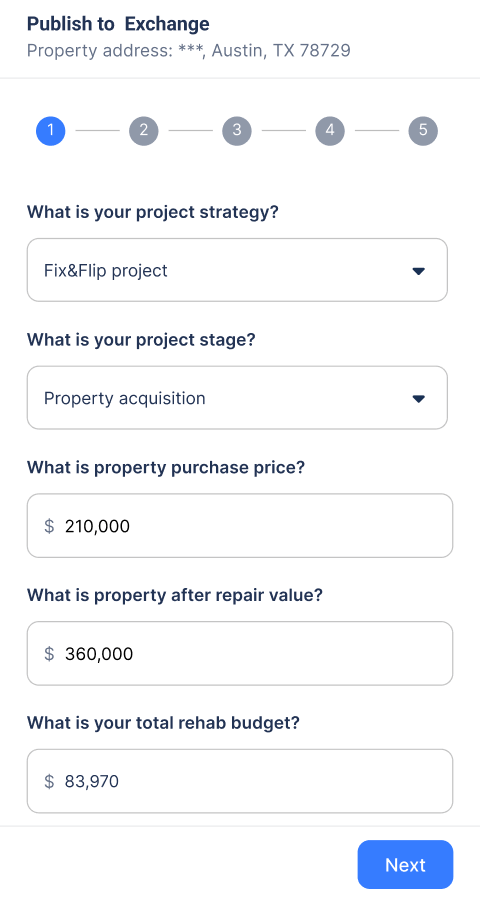

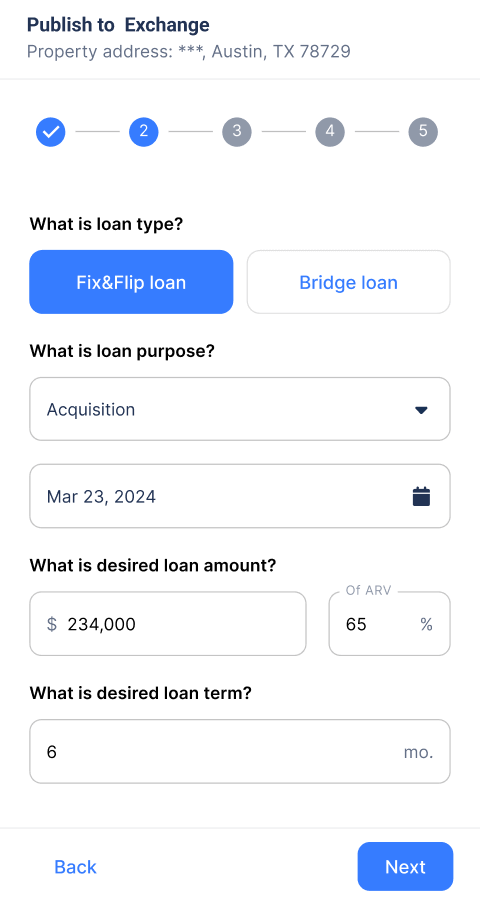

Publish your project on Exchange

Submit your project to the Exchange anonymously where lenders can offer you tailored financing solutions that best fit your needs

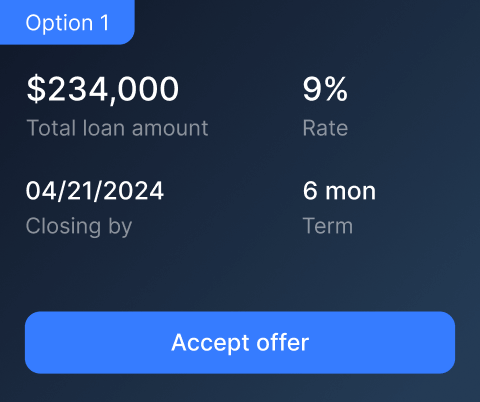

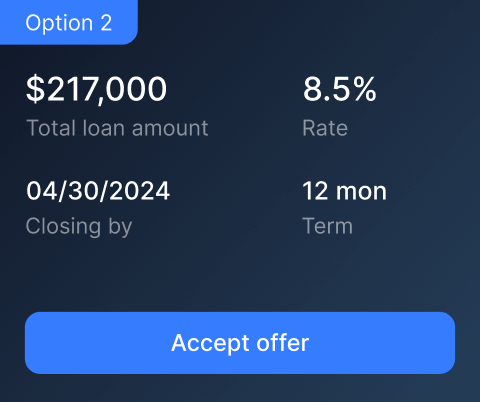

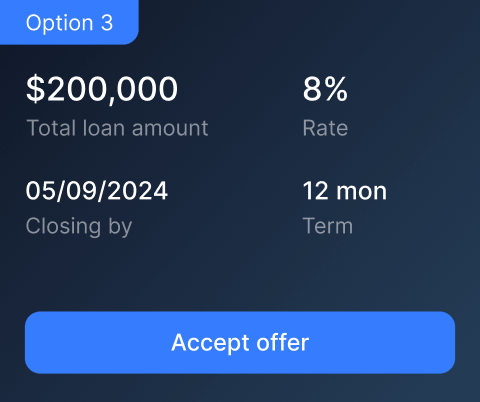

Choose your loan offer and connect

Select the offer that works best for your goals and begin to connect with the lender to begin the application process directly on the platform.

The Lending Exchange Advantage

By partnering with our platform, you tap into a network that combines expertise, speed, and flexibility. Here’s why it works for you:

Streamlined Process

Submit your project details and compare multiple loan offers in one place, saving you time and effort.

Vetted Lenders

Every lender in our network is carefully selected for their reputation, experience, and commitment to quality service.

No Subscription Fees

Access our platform at no cost—only pay the fees tied to your chosen loan.

Mobile-Friendly

Manage your financing needs on the go, with full access from any mobile device.

Advanced Technology

Our platform leverages cutting-edge cloud technologies and data APIs to deliver a fast, secure, and efficient experience.

Success Story Fix&Flip

- Project Details: An investor in California identified a distressed single-family home in a burgeoning neighborhood, aiming to renovate and sell it for a profit.

- Loan Details: They secured a Fix&Flip Loan of $250,000 at 9.5% interest with a 12-month term, facilitating both the purchase and renovation costs.

- Outcome: After investing $50,000 in renovations over 6 months—including a modern kitchen upgrade and exterior improvements—the property sold for $375,000. This resulted in a $75,000 profit after accounting for loan repayment and associated costs.

- Why It Worked: The lender’s swift 10-day closing process enabled the investor to quickly acquire the property and commence renovations, allowing them to capitalize on market opportunities and maximize returns

Success Story Multifamily Refinance

- Project Details: A seasoned investor in Ohio owned a 10-unit apartment building and sought to refinance to reduce their interest rate and pull out cash for future investments.

- Loan Details: Refinance with a Multifamily Loan of $800,000 at 5.5% interest on a 25-year term, replacing their previous 7.25% loan.

- Outcome: The refinance lowered their monthly payment by $900, and they extracted $150,000 in equity, which they used to acquire another property.

- Why It Worked: The platform helped them find a lender offering the lowest rate, and the streamlined process cut refinancing time to just 3 weeks.

Success Story Mixed-Use Development

- Project Details: An entrepreneur in New York needed funding for a mixed-use property combining ground-floor retail space and upstairs apartments in an urban area.

- Loan Details: They secured a Mixed-Use Bridge Loan of $1,500,000 at 9.75% interest with a 12-month term to cover acquisition and initial renovations.

- Outcome: After completing renovations in 8 months, they leased the retail space for $8,000 monthly and the apartments for $6,000, then refinanced into a long-term loan, stabilizing their cash flow.

- Why It Worked: The platform connected them with a lender comfortable with mixed-use projects, and the fast 9-day closing ensured they could act quickly in a competitive market.

Success Story Land Purchase for Future Development

- Project Details: A developer in Arizona identified a prime 5-acre parcel for a future residential subdivision but needed short-term financing to secure it.

- Loan Details: Through Lending Exchange, they obtained a Land Loan of $300,000 at 11% interest with a 24-month term.

- Outcome: They held the land for 18 months, completed zoning approvals, and sold it to a homebuilder for $450,000, earning a $100,000 profit after loan repayment.

- Why It Worked: The platform’s network of niche lenders offered flexible terms for raw land, and the investor saved time by comparing multiple offers in one place.

Ready to Find Your Ideal Financing?

Sign up today and explore how Lending Exchange can elevate your real estate investments. Our network of top lenders is ready to provide the funding you need to succeed.